In an era where financial literacy is more important than ever, mastering the art of personal finance management is crucial. The year 2024 brings its own set of financial challenges and opportunities, and being well-versed in managing your finances can lead to a more secure and prosperous future. This blog post aims to provide valuable insights and practical tips on how to effectively manage your personal finances in 2024.

Understanding Personal Finance in 2024

The landscape of personal finance is constantly evolving, with new investment opportunities, digital currencies, and changing economic conditions. Staying informed and adaptable is key to successful financial management.

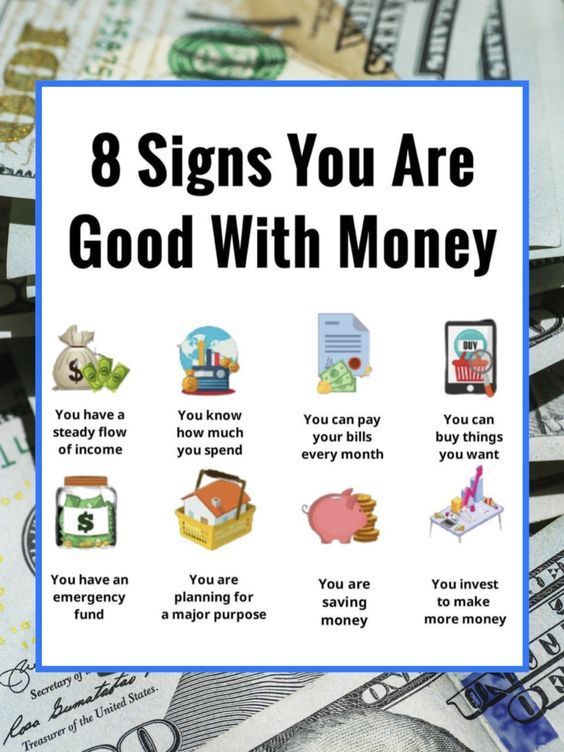

1. Budgeting and Expense Tracking

- Create a Realistic Budget: Start by understanding your income and expenses. Create a budget that covers your necessities, savings, and discretionary spending.

- Track Your Spending: Use apps or traditional methods to track your spending. This helps in identifying areas where you can cut back.

2. Saving and Investing

- Emergency Fund: Build an emergency fund that covers at least three to six months of living expenses.

- Investing: Consider various investment options like stocks, bonds, mutual funds, or real estate. In 2024, also explore digital assets like cryptocurrencies, but be sure to understand the risks involved.

3. Managing Debt

- Debt Strategy: Prioritize paying off high-interest debts first. Avoid accumulating unnecessary debt and understand the terms of any loans or credit you use.

- Credit Score: Maintain a good credit score by paying bills on time and keeping your credit utilization low.

4. Retirement Planning

- Start Early: The earlier you start saving for retirement, the better. Take advantage of compounding interest over time.

- Retirement Accounts: Maximize contributions to retirement accounts like 401(k)s, IRAs, or any other pension plans available in your country.

5. Insurance and Protection

- Health Insurance: Ensure you have a comprehensive health insurance plan.

- Life and Disability Insurance: Consider life and disability insurance to protect your income and your family’s financial future.

6. Financial Education and Resources

- Stay Informed: Keep up with financial news and trends. Read books, follow blogs, or take courses to enhance your financial literacy.

- Professional Advice: Don’t hesitate to consult with financial advisors for personalized advice, especially for complex financial decisions.

7. Digital Tools and Apps

- Utilize Technology: Leverage financial apps and tools for budgeting, investing, and tracking your wealth. Many apps now offer automated savings and investment features.

8. Mindful Spending

- Value-Based Spending: Align your spending with your values and long-term goals. Avoid impulsive purchases and focus on what truly brings value to your life.

Managing your personal finances effectively in 2024 requires a combination of discipline, continuous learning, and the smart use of technology. By budgeting wisely, saving and investing for the future, managing debt, and staying informed, you can achieve financial stability and peace of mind. Remember, the journey to financial freedom starts with taking control of your finances today.